Analysis of OPM’s Financial Statements

In accordance with the Chief Financial Officers Act of 1990 (CFO Act) and the Government Management Reform Act of 1994 (GMRA), OPM prepares consolidated and consolidating financial statements for Retirement, Health Benefits, Life Insurance and Other Programs. For the 25th consecutive year, OPM received an unmodified or “clean” audit opinion on the Consolidated Balance Sheets, and related Consolidated Statement of Net Cost, Changes in Net Position, and Combined Statements of Budgetary Resources, and related notes for the fiscal years ended September 30, 2024 and 2023. This includes the individual Balance Sheets of the Retirement, Health Benefits, and Life Insurance Programs and the related individual Statements of Net Cost, and Changes in Net Position, and Budgetary Resources and related notes to the individual financial statements.

| Summary Consolidated Statements of Net Cost | September 30, 2024 (In Billions) |

September 30, 2023 (In Billions) |

|---|---|---|

| Gross Costs | $274.7 | $235.4 |

| Less: Earned Revenue | (150.1) | (136.8) |

| (Gain)/Loss in Pension, ORB1 , or OPEB2 Assumption Changes | 83.8 | 111.9 |

| Total Net Cost of Operations | $208.4 | $210.5 |

| Summary Combined Statements of Budgetary Resources | September 30, 2024 (In Billions) |

September 30, 2023 (In Billions) |

|---|---|---|

| Unobligated Balance, from Prior Year Budget Authority, Net | $73.6 | $73.0 |

| Appropriations | 181.2 | 173.9 |

| Spending Authority from Offsetting Collections | 75.3 | 70.2 |

| Total Budgetary Resources | $330.1 | $317.1 |

Footnote 1

Other retirement benefits (ORB)

Footnote 2

Other post-employment benefits (OPEB)

Overview of Financial Position

Balance Sheet

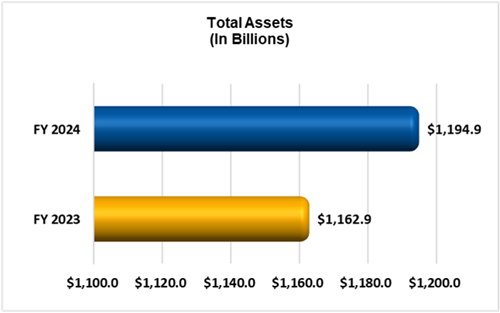

Figure 1: Total Assets for the Years Ended September 30, 2024 and 2023

Figure 1: Total Assets for the Years Ended September 30, 2024 and 2023

The Total Assets bar chart is in billions of dollars.

The first bar chart is total assets of FY 2024 and the amount is $1,194.9, and the 2nd bar chart is total assets of FY 2023, the amount is $1,162.9.

Assets. At the end of FY 2024, OPM held $1,194.9 billion in assets, an increase of $32.0 billion from $1,162.9 billion at the end of FY 2023. The majority of OPM’s assets are intragovernmental, representing activity with other Federal entities. As required, the Balance Sheet separately identifies intragovernmental assets from assets With the Public.

OPM’s largest category of assets is investments at $1,186.6 billion, which increased approximately $33.5 billion in FY 2024. While this represents 99.3 percent of all assets, the change for the fiscal year is less than 3 percent. Retirement is responsible for the majority of the increase due to investing receipts in special securities issued by the Department of the Treasury (Treasury), that are not immediately required for payment. This is a normal course of business for OPM trust funds.

The Retirement program is made up of two major programs within the Civil Service Retirement and Disability Fund (CSRDF), CSRS and FERS. Asset balances are tracked separately, however the entirety of the CSRDF is available for payment of benefits in either program. Due to the overall CSRS fund diminishing each year due to benefit expenses exceeding program revenues and collections, a funding transfer from FERS to CSRS is made annually. In FY 2024, $26.9 billion was recorded as an asset transfer moving investments between programs.

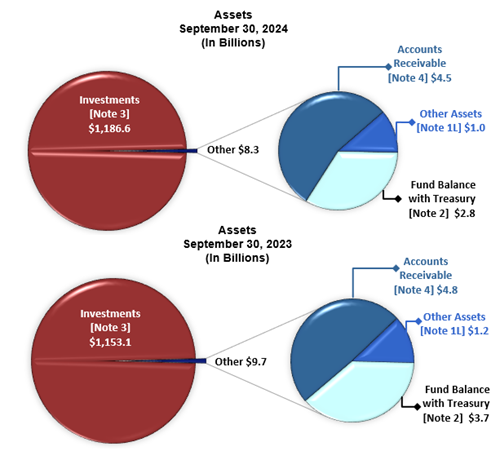

Figure 2: Assets by Type for the Years Ended September 30, 2024 and 2023

Figure 2: Assets by Type for the Years Ended September 30, 2024 and 2023

The Assets by Type pie chart is in billions of dollars.

OPM’s Assets has four categories: Accounts Receivable (Note 4), Fund Balance with Treasury (Note 2), Investments (Note 3), and Other Assets (Note 1L). Additional information is provided of each category in notes section of Financials.

As of September 30, 2024, Investments $1,186.6, Account Receivable $4.5, Other Assets $1.0, and Fund balance with Treasury $2.8

As of September 30, 2023, Investments $1,153.1, Account Receivable $4.8, Other Assets $1.2, and Fund balance with Treasury $3.7

OPM’s net intragovernmental accounts receivable of $2.6 billion includes a receivable of $27.3 billion due from USPS offset by an allowance of $27.1 billion for amounts deemed uncollectable due to USPS budget constraints. See Note 4, Accounts Receivable, Net for more information. This is comparable to the $2.7 billion reported in FY 2023 that included a USPS receivable and allowance of $22.7 billion.

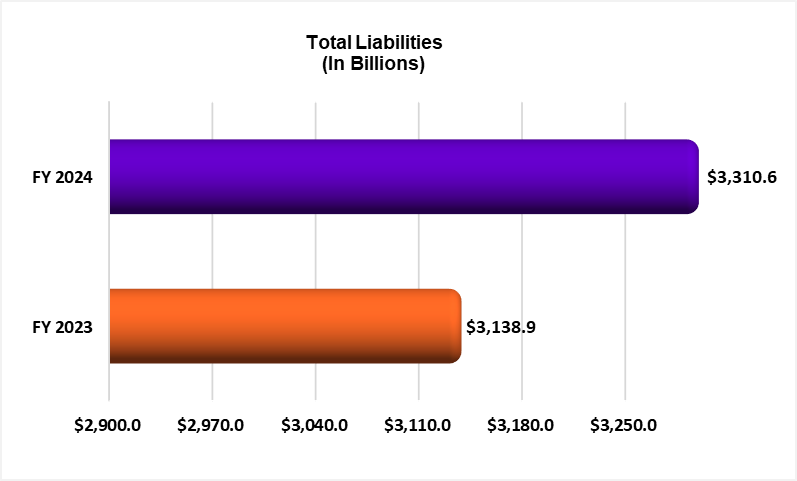

Liabilities. At the end of FY 2024, OPM’s total liabilities were $3,310.6 billion, an increase of 5.5 percent from $3,138.9 billion at the end of FY 2023. Pensions, OPEB Payable is the largest category of Liabilities, which represents 99.9 percent of the total.

Pensions, OPEB Payable represent an estimate of the future cost in today’s dollars to provide earned benefits to participants in the future. It increased approximately $171.6 billion from the end of FY 2023, mainly due to impacts from assumption changes such as program changes, increased general salary rates, and inflation factors.

Figure 3: Total Liabilities for the Years Ended September 30, 2024 and 2023

Figure 3: Total Liabilities for the Years Ended September 30, 2024 and 2023

The Total Liabilities bar chart is in billions of dollars.

The first bar chart is total liabilities of FY 2024 and the amount is $3,310.6, and the 2nd bar chart is total liabilities of FY 2023, the amount is $3,138.9

To compute these liabilities, the actuaries make assumptions about economic factors and the demographics of the future of Federal employee workforce and annuitants, retirees, and their survivors’ populations. The assumed future rates of cost-of-living adjustment (COLA) and general salary increase in FY 2024 were substantially different from the percentages used in the previous valuations, driving a significant increase in the projected actuarial liabilities for all OPM trust funds. FEHB’s future annuitant costs estimates were also impacted by results of the Postal Service Reform Act (PSRA), the Inflation Reduction Act in 2022, as well as with the introduction and participation in the Prescription Drug Program Employer Group Waiver Plans (EGWP) in 2024. See Note 6, Pensions, OPEB Payable in the Financial Section for additional information.

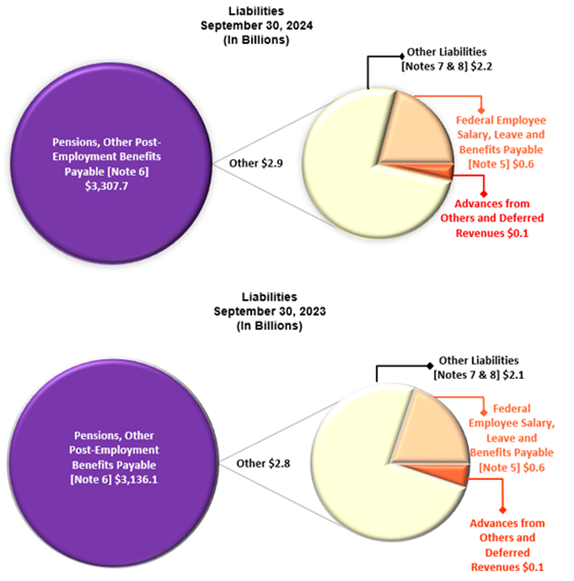

Figure 4: Liabilities by Type for the Years Ended September 30, 2024 and 2023

Figure 4: Liabilities by Type for the Years Ended September 30, 2024 and 2023

The Liabilities by Type pie chart is in billions of dollars.

OPM’s Liabilities have four categories: Advances from others and Deferred Revenues; Federal Employee Salary, Leave and Benefits payable (Note 5); Pensions, Other Post-Employment Benefits Payable (Note 6); and Other Liabilities (Notes 7&8) Additional information is provided of each category in notes section of Financials.

As of September 30, 2024, Pensions, Other Post-Employment Benefits Payable $3,307.7, Other Liabilities $2.2, Federal Employee Salary, Leave and benefits payable $0.6, and Advances from Others and Deferred Revenues $0.1.

As of September 30, 2023, Pensions, Other Post-Employment Benefits Payable $3,136.1, Other Liabilities $2.1, Federal Employee Salary, Leave and benefits payable $0.6, and Advances from Others and Deferred Revenues $0.1

Net Position. OPM’s Net Position is classified into two separate balances. The Cumulative Results of Operations comprise OPM’s net results of operations since its inception. Unexpended Appropriations is the balance of appropriated authority granted to OPM against which no expenditures or outlays have been made.

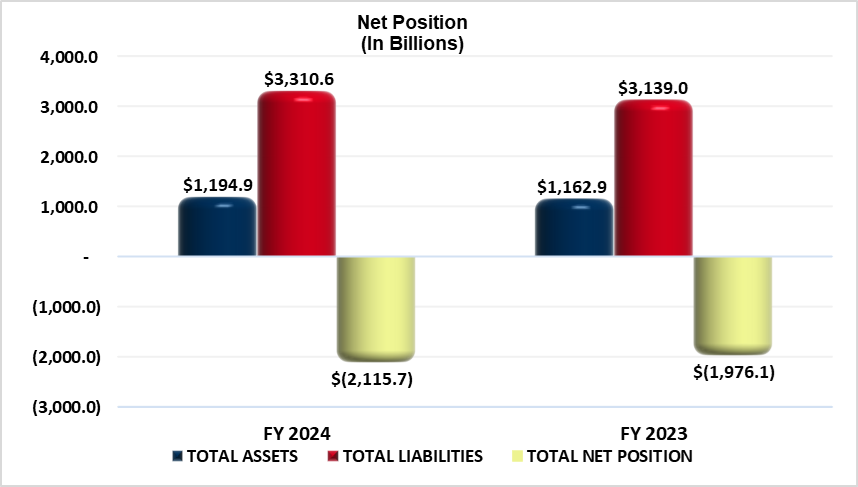

Figure 5: Total Net Position for the Years Ended September 30, 2024 and 2023

Figure 5: Total Net Position for the Years Ended September 30, 2024 and 2023

Total Net Position bar chart is in billions of dollars.

As of September 30, 2024, Total assets column is $1,194.9, Total liabilities column is $3,310.6, Net Position column is negative $2,115.7.

As of September 30, 2023, Total assets column is $1,162.9, Total liabilities column is $3,139.0, Net Position column is negative $1,976.1

OPM’s total liabilities exceeded its total assets at the end of FY 2024 by $2,115.7 billion, primarily due to the large actuarial liabilities. However, it is important to note that the Retirement, Health Benefits, and Life Insurance Programs are funded in a manner that ensures there will be sufficient assets available to pay benefits well into the future.

Table 7 – Net Assets Available for Benefits – shows that OPM’s net assets available to pay benefits have increased by $31.9 billion in FY 2024 to $1,176.6 billion.

Statement of Net Cost

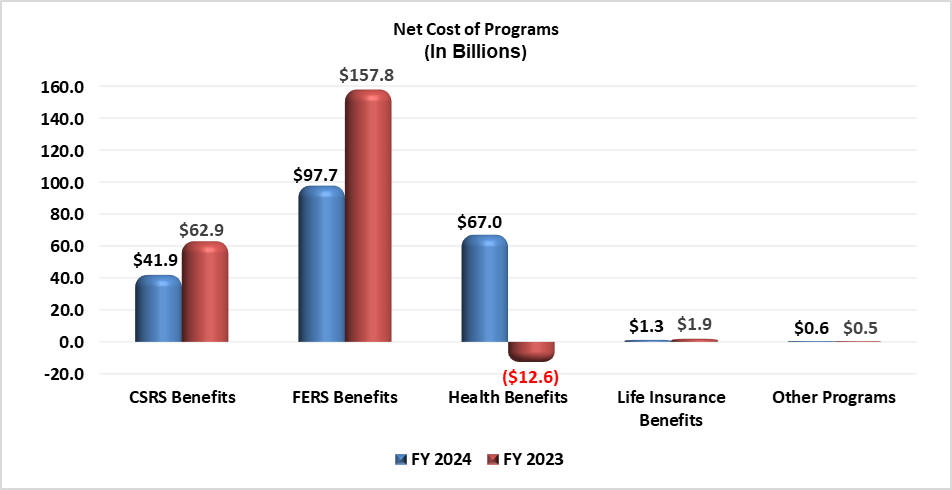

Statement of Net Cost presents the gross cost incurred by OPM, less exchange revenues earned by its benefits and services. Gains and losses related to Pension, ORB, or OPEB Assumption used to measure program liabilities are reported separately and calculated into the Net Cost of Operations for the agency. It includes four major categories of benefits and services: Civil Service Retirement and Disability Benefits (CSRS and FERS), Health Benefits, Life Insurance Benefits, and Other Programs. In FY 2024, Net Cost of Operations totaled $208.4 billion and consisted of Gross Costs of $274.7 billion less Earned Revenue of $150.1 billion, and Net Losses of $83.8 billion.

Figure 6: Net Cost of Programs for the Years Ended September 30, 2024 and 2023

Figure 6: Net Cost of Programs for the Years Ended September 30, 2024 and 2023

Net Cost of Programs bar chart is in billions of dollars.

CSRS Benefits Net Cost of Programs column is $41.9 in FY 2024 and $62.9 in FY 2023.

FERS Benefits Net Cost of Programs column is $97.7 in FY 2024 and $157.8 in FY 2023

Health Benefits Net Cost of Programs column is $67.0 in FY 2024 and Negative $12.6 in FY 2023

Life Insurance Benefits Net Cost of Programs column is $1.3 in FY 2024 and $1.9 in FY 2023

Other Programs Net Cost of Programs column is $0.6 in FY 2024 and $0.5 in FY 2023

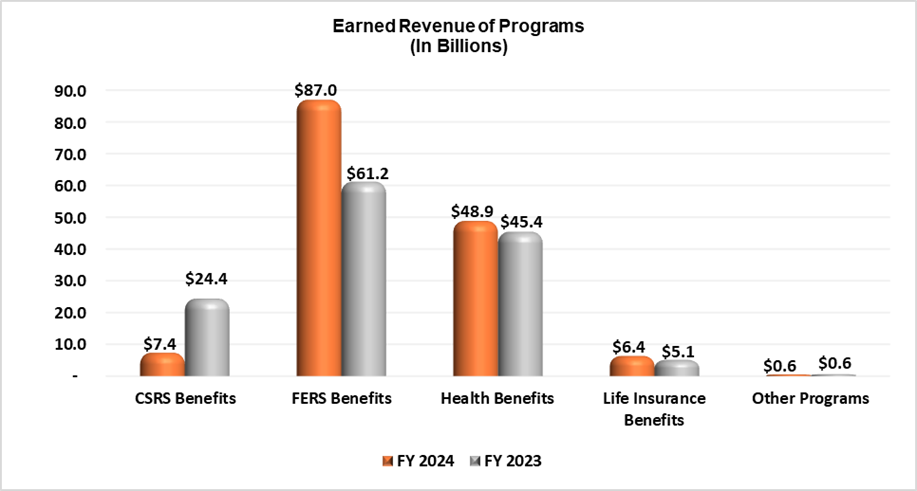

Earned Revenue. Employer and participant contributions and investments are two main categories of earned revenue. Total earned revenues for the year ended September 30, 2024, increased by $13.3 billion, or 9.8 percent, from FY 2023. The increase of approximately $9.0 billion was attributed to increased contributions collected as a result of increased healthcare premiums, the January 2024 general salary pay increase of 5.2 percent compared to 4.6 percent in FY 2023, increased cost of living adjustment, and approximately ninety-five thousand new life insurance entrants in FY 2023. In addition, programs earned approximately $4.3 billion more in investment earnings due to larger investment portfolios and higher interest rates in the first three quarters of FY 2024.

Figure 7: Earned Revenue of Programs for the Years Ended September 30, 2024 and 2023

Figure 7: Earned Revenue of Programs for the Years Ended September 30, 2024 and 2023

Earned Revenue of Programs bar chart is in billions of dollars.

CSRS Benefits Earned Revenue column is $7.4 in FY 2024 and $24.4 in FY 2023.

FERS Benefits Earned Revenue column is $87.0 in FY 2024 and $61.2 in FY 2023

Health Benefits Earned Revenue column is $48.9 in FY 2024 and $45.4 in FY 2023

Life Insurance Benefits Earned Revenue column is $6.4 in FY 2024 and $5.1 in FY 2023

Other Programs Earned Revenue column is $0.6 in FY 2024 and $0.6 in FY 2023

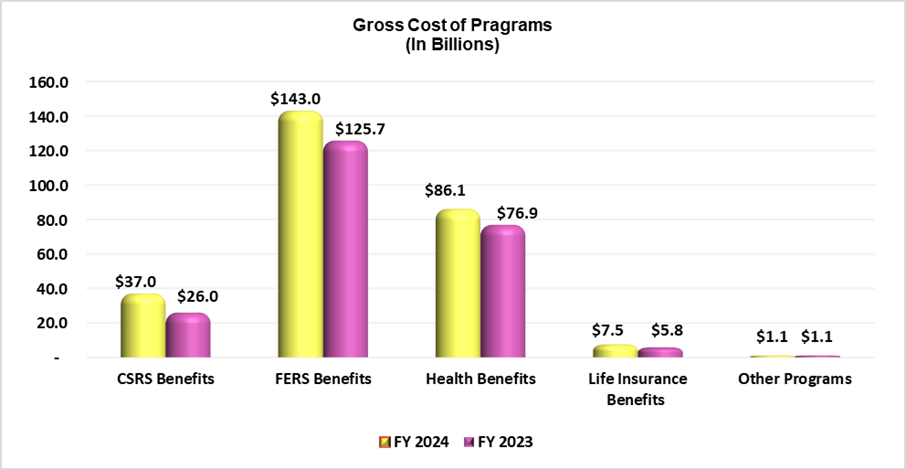

Gross Cost. Agency gross costs for FY 2024 were $274.7 billion compared to $235.4 billion in FY 2023. The majority of the increase is due to Retirement ($28.4 billion) and Health ($9.2 billion) benefit programs.

Retirement pension expense increased due to updated actuarial cost projections based on current year population applied to prior year-end assumption rates. The factors used for inflation, annuitant COLA and the general salary increase, drastically increased from FY 2022 to FY 2023. Retirement also recognized a loss due to actual plan experience through the end of FY 2024 compared to expectation used in the current year valuations. For example, FY 2024’s general salary increase was 5.2 percent compared to the prior annual assumption of 2.1 percent.

Health’s post-retirement benefit cost increased by $3.8 billion in FY 2024 mainly due to the recognition of an experience assumption loss on the actuarial liability of $0.8 billion. The current year loss is mostly due to population changes and actual healthcare costs exceeding prior expectations. In addition, the cost of current benefits and premiums also increased approximately $5.4 billion mostly due to increased healthcare costs and claims payments made in FY 2024.

Figure 8: Gross Cost of Programs for the Years Ended September 30, 2024 and 2023

Figure 8: Gross Cost of Programs for the Years Ended September 30, 2024 and 2023

Gross Cost of Programs bar chart is in billions of dollars.

CSRS Benefits Gross Cost of Programs column is $37 in FY 2024 and $26 in FY 2023.

FERS Benefits Gross Cost of Programs column is $143 in FY 2024 and $125.7 in FY 2023

Health Benefits Gross Cost of Programs column is $86.1 in FY 2024 and $76.9 in FY 2023

Life Insurance Benefits Gross Cost of Programs column is $7.5 in FY 2024 and $5.8 in FY 2023

Other Programs Gross Cost of Programs column is $1.1 in FY 2024 and $1.1 in FY 2023

Actuarial Gain and Loss. Due to actuarial gains and losses, OPM’s Net Cost to Provide Retirement, Health Benefits, and Life Insurance Benefits can vary widely year to year. In computing the Pension, Post-Retirement Health Benefits, and Actuarial Life Insurance Liabilities, OPM’s actuaries must make assumptions about the future. When the actual experience of the Retirement, Health Benefits, and Life Insurance Programs differs from these assumptions, as it generally will, actuarial gains and/or losses will occur. For example, if the COLA increase is less than the actuary assumed, there will be an actuarial experience gain as it will cost the Government less. A decrease in the assumed future rate of inflation would produce a gain. These gains and losses are recognized when expected changes in estimated factors result in a different projection from what was previously used for valuation.

Long-term assumption-based actuarial gains and losses are a result of several factors such as changes to long-term averages based on current year actual rates and cost, new or updated program information, new or updated program information, and revised demographic assumptions.

The major components contributing to OPM’s current year loss were changes to the assumed future rates of inflation and the general salary increases. The Health Benefits program also continues to be significantly impacted by the recent legislation and plan changes in the FEHB program. The PSRA and the Inflation Reduction Act in 2022, as well as the introduction of Prescription Drug Program (PDP) EGWPs in FEHB in 2024 have created a shift in future annuitant costs from the FEHB to the Medicare program, creating large changes in the liability calculations. The largest contributor to the FY 2024 loss is driven by new information associated with actuals versus expectation of participation in the EGWP program.

Statement of Budgetary Resources

In accordance with Federal statutes and implementing regulations, OPM may incur obligations and make payments to the extent it has budgetary resources to cover such items. The Statement of Budgetary Resources (SBR) presents the sources of OPM’s budgetary resources, their status at the end of the year, obligated balances, and the relationship between its budgetary resources and the outlays disbursed.

As presented in the SBR, OPM had access to a total of $330.1 billion in budgetary resources for FY 2024.

Unobligated Balance from Prior Year Budget Authority. In FY 2024, unobligated balances from the prior year’s budget authority amounted to $73.6 billion. These funds represent unused balances that roll forward from the previous year. See Note 13 for more information.

Appropriations include appropriated resources to cover the Government’s share of cost related to health and life insurance benefits for Retirement program annuitants. Retirement also receives a General Fund warrant annually for supplement funding for the CSRDF.

Trust Fund Receipts are Retirement Program and Postal Service Retiree Health Benefit Fund (PSRHBF) contributions and withholdings from participants, and interest on investments. Of the $143.1 billion in new receipts this fiscal year, $34.4 billion was precluded from obligation in the Retirement program, while ($3.8) billion of previously precluded from obligation funds were made available to cover current year costs in the PSRHBF. Remaining funds precluded from obligation in these programs are available for obligation and expenditure, upon Apportionment by OMB, without further action by Congress. See Note 10 for more details.

Spending Authority from Offsetting Collections includes contributions made by and for those participating in the Health Benefits and Life Insurance, and revenues in Revolving Fund Programs. OPM saw an increase for the fiscal year of $5.1 billion mainly due to healthcare’s premium increase that went into effect in January 2024. Life Insurance had a smaller increase primarily due to approximately ninety-five thousand new entrants.

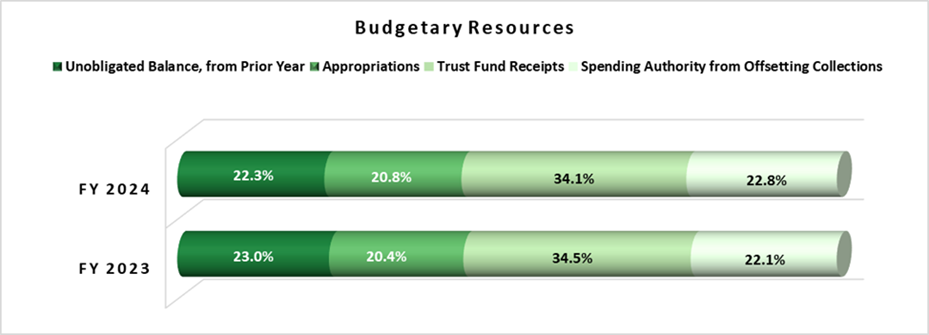

Figure 9: Budgetary Resources by Percentage for the Years Ended September 30, 2024 and 2023

Figure 9: Budgetary Resources by Percentage for the Years Ended September 30, 2024 and 2023

Budgetary Resources charts include four categories: Unobligated Balance, from prior year, Appropriations, trust fund receipts, and Spending authority from offsetting collections.

As of September 30, 2024, Unobligated balance, from prior year is 22.3%, Appropriations is 20.8%, trust fund receipts is 34.1%, and spending authority form offsetting collections is 22.8%

As of September 30, 2023, Unobligated balance, from prior year is 23.0%, Appropriations is 20.4%, trust fund receipts is 34.5%, and spending authority form offsetting collections is 22.1%

Of the $330.1 billion in budgetary resources, OPM obligated $256.0 billion of these funds in FY 2024. This includes $68.4 billion of obligations in the program payment accounts that were incurred moving warranted appropriations received from OPM general funds into expenditures trust funds accounts for benefits to be paid for participants in the Retirement, Health Benefits and Life Insurance Programs.

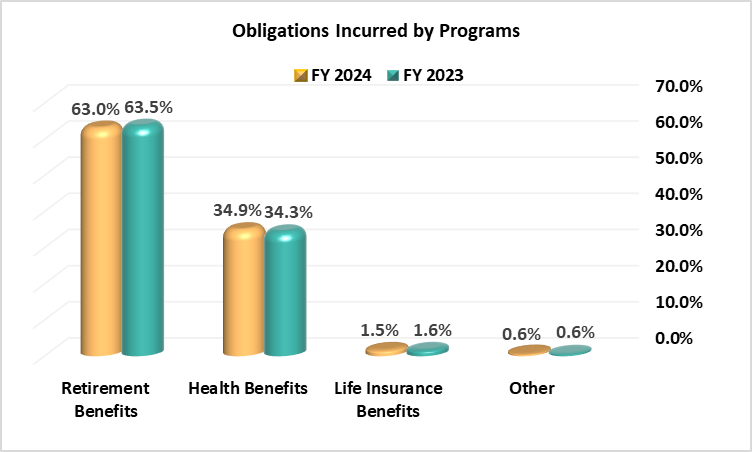

Figure 10: Obligations Incurred by Program for the Years Ended September 30, 2024 and 2023

Figure 10: Obligations Incurred by Program for the Years Ended September 30, 2024 and 2023

The Obligations Incurred by Program bar chart displaying program percentages for the fiscal year.

As of September 30, 2024, Retirement benefits column is 63.0% and at the end of September 30, 2023, Retirement benefits column is 63.5%

As of September 30, 2024, Health benefits column is 34.9% and at the end of September 30, 2023, Health benefits column is 34.3%

As of September 30, 2024, Life Insurance benefits column is 1.5% and at the end of September 30, 2023, Life insurance benefits column is 1.6%

As of September 30, 2024, Other column is 0.6% and at the end of September 30, 2023, Other column is 0.6%

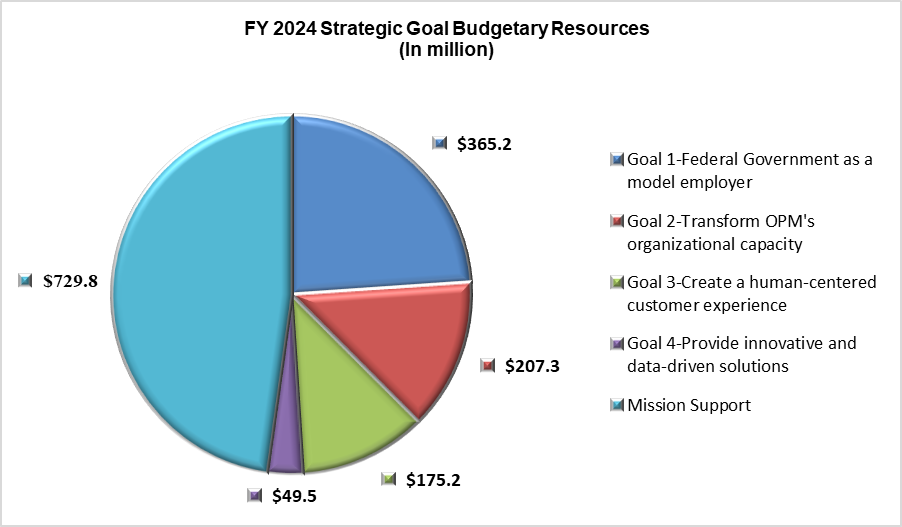

Financial Link to Strategic Goals

OPM’s financial statements reflect the resources required and used to accomplish the agency’s mission goals and objectives. The majority of OPM’s budgetary resources and net cost activity is associated with pass-through activity of resources collected and paid that provide benefits to current and retired employees. While this is an important part of OPM’s mission and required operations, OPM’s trust fund benefit program activity is not directly associated with the FY 2022 – 2026 Strategic Plan that is designed around serving as champions of talent in the workforce.

OPM’s Other Programs track and report resources spent to implement the strategies designed to achieve the goals defined. A large portion of OPM administrative costs is attributed to mission support common services such as rent, salaries and benefits, and support service contracts.

The chart below shows a breakdown of the Other Program’s FY 2024 obligations incurred that are associated with OPM’s Strategic Plan.

Figure 11: Strategic Goal Budgetary Resources

Figure 11: FY 2024 Strategic Goal Budgetary Resources pie chart

The FY 2024 obligations by dollar amount (in millions) that are incurred that are associated with OPM’s strategic plan.

- Goal 1: Federal Government as a model employer $365.2

- Goal 2: Transform OPM's organizational capacity $207.3

- Goal 3: Create a human-centered customer experience $175.2

- Goal 4: Provide innovative and data driven solutions $49.5

- Mission Support $729.8